25+ Mortgage offer calculator

See which type of mortgage is right for you and how much house you can afford. Second mortgages come in two main forms home equity loans and home equity lines of credit.

1

The mortgage points calculator will help you to calculate whether or not it is going to be beneficial for you to buy mortgage points or not.

. Most BTL loans are structured as interest-only. The average days for a home to be on the market before an offer is made in the UK is 47 days. This Comparison Rate applies only to the example or examples given.

The comparison rate provided is based on a loan amount of 150000 and a term of 25 years. Land Transfer Tax LTT 28473. This mortgage calculator is a well-equipped loan calculator that deals with multiple questions arising when you are about to.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. This is not an offer to buy or sell any security or interest.

A typical mortgage length is 25 years. Mortgage loan basics Basic concepts and legal regulation. The longer your term the less you may pay each month but youll end up paying more in interest.

Such as major banking institutions who can offer lower mortgage rates and private lenders. Use our free mortgage calculator to easily estimate your monthly payment. Free Canadian Mortgage Calculator - Use our Mortgage Calculator for Canada to calculate your monthly mortgage repayments and interest amounts.

25 years in 76296. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. Since lower initial payment usually associates with higher risk to the lender its sum also.

For instance 5125 could be. The minimum downpayment on BTL loans is usually 25 though it can range from 20 to 40. All investing involves risk including loss of principal.

Use SmartAssets free mortgage calculator to estimate your monthly mortgage payments including PMI homeowners insurance taxes interest and more. Mortgage rates are based primarily on MBS and the structure of the MBS market can occasionally result in it being more profitable for a lender to offer a lower rate. Lump sum payments mortgage calculator.

In the US for example the down payments range from 35 FHA loans to 20-25 of the purchase price. It is important to note that interest costs increase significantly if the amortization period is over 25 years. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. And while its not a guaranteed mortgage offer its a helpful way of showing sellers you can afford to buy and are serious about doing so. This time last week the 30-year fixed APR was 615.

This is because a larger down payment means youre less likely. Negative discount points are an option a lender may offer to reduce closing costs. You can try working with an independent mortgage broker who can help estimate a shorter term that you can comfortably.

Partners Providing you own 25 share or more of the limited liability partnership your share of average net profits over the last 2-3 years will be considered income for mortgage purposes. This table above used the simple mortgage calculator to determine the total. This is the length of time the mortgage terms and conditions are in.

If you plan to move before the five-year ARM resets you are going to save a lot of money on interest. But thats not all. A 30-year fixed-rate mortgage in comparison would give you an interest rate of 425.

We recommend keeping your mortgage payment to 25 or less of your monthly take-home pay. Second mortgage types Lump sum. Adjustable-rate mortgages also offer points but they only lower the interest cost during the introductory rate period.

Contractors Lenders may use an annualised version of your day rate or an average of your net profits depending on the type of contractor you are. Enter an amount between -25 and 25. Enter an amount between 0 and 25.

Learn how to use our mortgage calculator to determine your monthly mortgage payments including PMI taxes insurance down payment interest rate and more. Wed love to chat how can we help. But note that it usually varies per lender and offer.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. If we go by region homes in both the East and Southeast of England are bought the. Typically you can get an APR reduction of 025 per point on fixed-rate mortgages.

Not all brokers or advisers offer the products of all lenders or solution providers. If you decide to refinance consider working with a lender that offers more flexible terms. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

They work just opposite of positive discount points instead of paying. A Scotiabank mortgage calculator is a great head start to the road to home ownership and for a greener home Scotiabank has a home energy savings calculator that offers suggestions for upgrades money-back rebates and simple ideas to help. Current Mortgage Rates.

Aug 25 Ethereums Merge is live heres what you need to know Crypto enthusiasts say a shift in how ethereum the second-most popular blockchain works will revolutionize digital. Total Of Payments. The average APR for the benchmark 30-year fixed-rate mortgage fell to 625 today from 631 yesterday.

Mortgage interest rates are always changing and there are a lot of factors that. There are lenders that can offer terms at 8 years or 20 years. But it also carries a lot more weight when youre ready to make an offer on a home.

Todays national mortgage rate trends. Whether youre a first-time buyer or are looking. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted.

Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. In addition to the conventional. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Your mortgage lender may offer you a lower interest rate if you make a larger down payment. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Traditional mortgages are limited to 15 and 30-year repayment schedules.

Before making any offer on a home you will want to prequalify or even better be preapproved for.

1

Pin On Everything Finance

Help My Client Is Questioning Pr Value What Should I Do Como Economizar Dinheiro Ganhar Dinheiro Online Financas

Download Obituary Samples Word 03 Obituaries Template Obituaries Newspaper Obituaries

Daily Habits Of 8 Top Real Estate Agents Real Estate Infographic Top Real Estate Agents Real Estate Tips

What Comes After A Seller Accepts Your Offer Infographic Real Estate Infographic Real Estate Tips Real Estate Marketing

How To Get Out Of Debt Fast The Science Backed Way Credit Card Payoff Plan Paying Off Credit Cards Good Credit

1

Download The Zero Based Budget Worksheet From Vertex42 Com Budgeting Worksheets Budgeting Money Saving Strategies

Summer Reading Log Reading Log Printable Reading Logs Reading Calendars

25 Cool Gifts For Guys That Are Upcycled And Repurposed Vintage Industrial Furniture Old Tools Repurposed

7 Free Printable Budgeting Worksheets Budgeting Budgeting Worksheets Budgeting Money

How Refinancing Your Student Loans Can Save You Thousands Conscious Coins Paying Off Student Loans Student Loans Refinance Student Loans

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

1

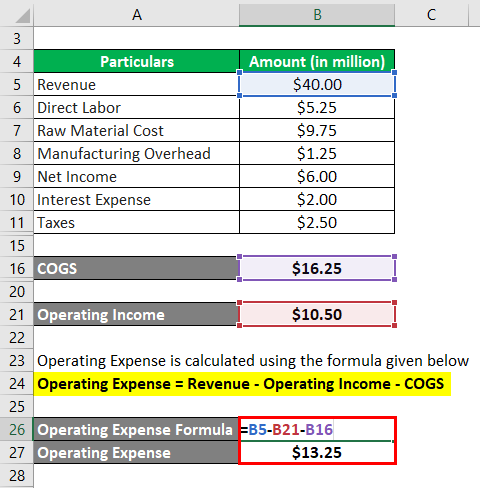

Operating Expense Formula Calculator Examples With Excel Template

Minimal Timeline Template Timeline Infographic Timeline Design Infographic Templates